Cover Your Costs with Convenience Fees

Kelly Percillier

Mar 23, 2023

Credit card processing fees can typically range from 2.87% to 4.35% on each transaction. Over time those fees can quickly add up and take a chunk out of your profit. That’s especially true if you are a small business.

At Upflow, we our goal is to help our customers improve their cash collection to maximize their cash flow. That’s why we are committed to providing innovative solutions to help your business succeed.

Offer new payment methods at no extra cost

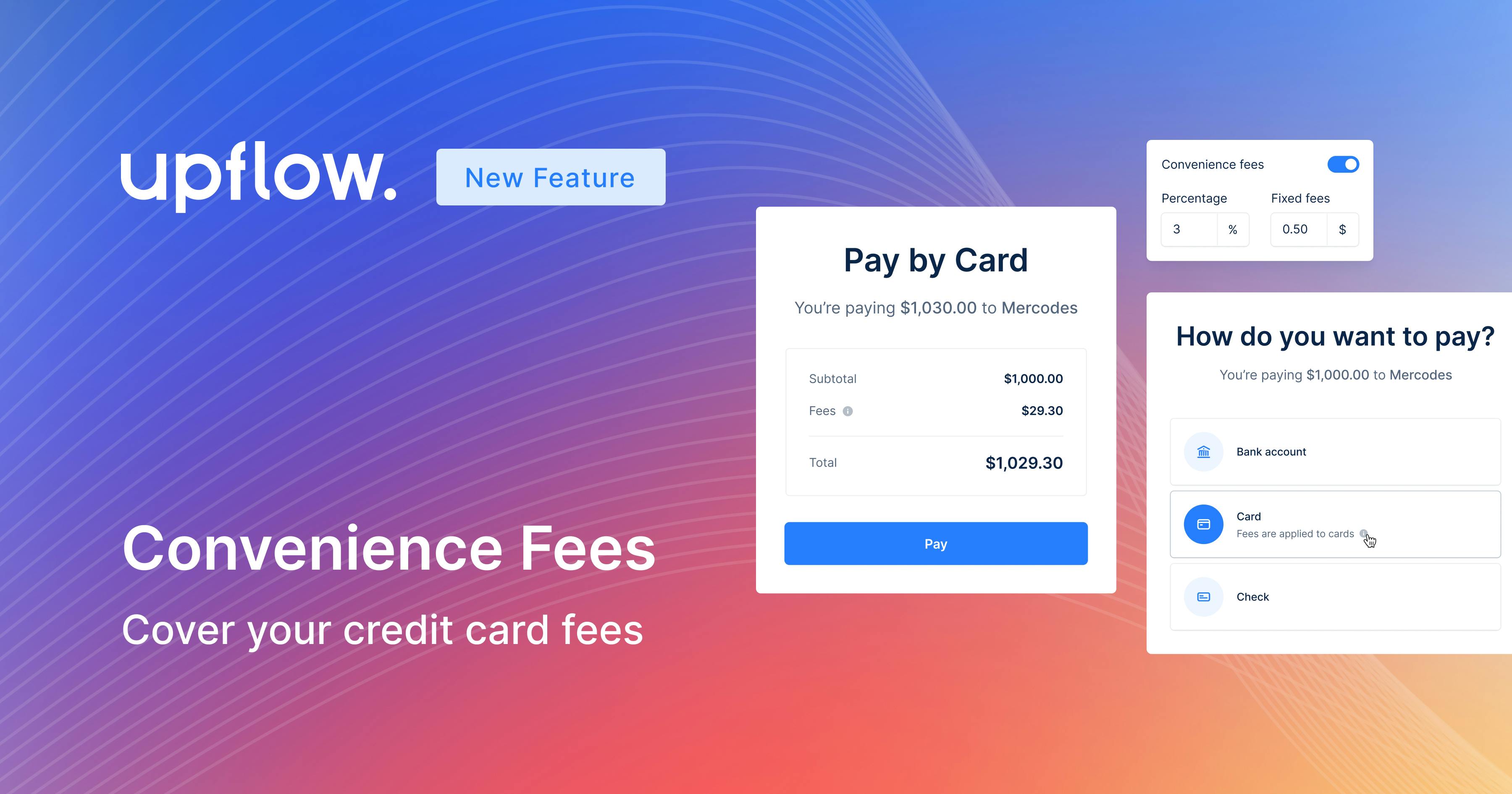

We are excited to announce the release of Convenience Fees, a new feature that can take your Accounts Receivable collection to the next level.

Today, most customers prefer to settle their invoices using a credit card. While this payment method is convenient for customers, the associated credit card fees are usually placed upon the merchant. These fees can sometimes exceed 4% and can be a barrier when you are considering new online payment methods.

Convenience Fees allow your business to collect the full payment amount owed and pass the payment gateway fee on to your customer. This in the long term can represent huge savings for your business. Not to mention that this is a standard practice in the US.

How does it work?

Convenience fees are a powerful feature for businesses looking to make payments easier on their customers by offering new and modern payment methods at no extra cost for your company. This feature is now directly embedded into our product, and you can easily toggle this option according to your different payment methods. It's important to keep in mind that this feature may not be legally suitable for all markets.

In the app, you will be able to define the fees of the credit card transactions of your Payment Gateway. How will they be calculated? The formula is the following: % component of 1.5 to 3% fixed component from 10cent to 30cent.

You’ll be able to enable or disable the convenience fees for all Credit Card transaction (it is off by default). When you toggle this setting, you’ll be made aware of the legal implications of this change. When Convenience fees are activated, the final amount is charged on the customer portal when they chooses to pay via Credit card. This fee is also applied automatically when the customer is on Autopay on Credit Card. The customer will then receive a receipt with the total amount of the charge. Upflow will then write back in your accounting software.

Give it a try and see how Upflow and Convenience Fees can help your business collect cash faster without paying a higher price!