What is an accounts receivable process?

Your accounts receivables process are the actions you take to handle your receivable management. A good cash collection process starts with setting up good workflows to get paid on time and avoid unpaid invoices. Small businesses and enterprise companies can streamline collection by integrating receivable automation software into their process. Setting up your receivable department with the right tools proactively anticipates potential liquidity problems and increases the amount of money you have to run your business. On top of that, it reduces your chances of having to go down the tricky path of performing debt collection activities.

The 6 steps to improve your accounts receivable process

Discover how to improve your cash collection and how automation can reduce your number of outstanding invoices.

1. Map your AR Collections Process

You first need to map out your current AR process and determine the tasks that are time-consuming or are causing issues. This will tell you what parts of your process need to be improved and what tasks could benefit from automation. Once completed, you can decide how automated you want your accounts receivable process to be.

2. Outline your needs

Now that you've identified your roadblocks you need to select the right AR software. Choosing a solution that integrates with your existing finance stack can streamline your AR process in just a few clicks. API integrations work best as they connect as one and provide the real-time data you need to have visibility over your receivable management.

5. Communicate with customers

Keep an open line of communication with your customers. Regularly sending reminders and following up speeds up your invoice processing time. Remember, customers are not bad payers, sometimes they simply forget or don't know how to pay you. Make it easy for them, regularly check in, remind them of your payment terms and offer online payment options (ACH, direct debit, or credit sales). Implementing AR software can automate these repetitive tasks for you.

6. Personalize communications

Personalize your accounts receivable process. Business owners and finance teams often overlook how customization can have a positive impact on your cash application process. Invoicing customers via personalized emails gets you paid fast and on time! Make sure to select AR software that allows you to fully or partially customize your communications.

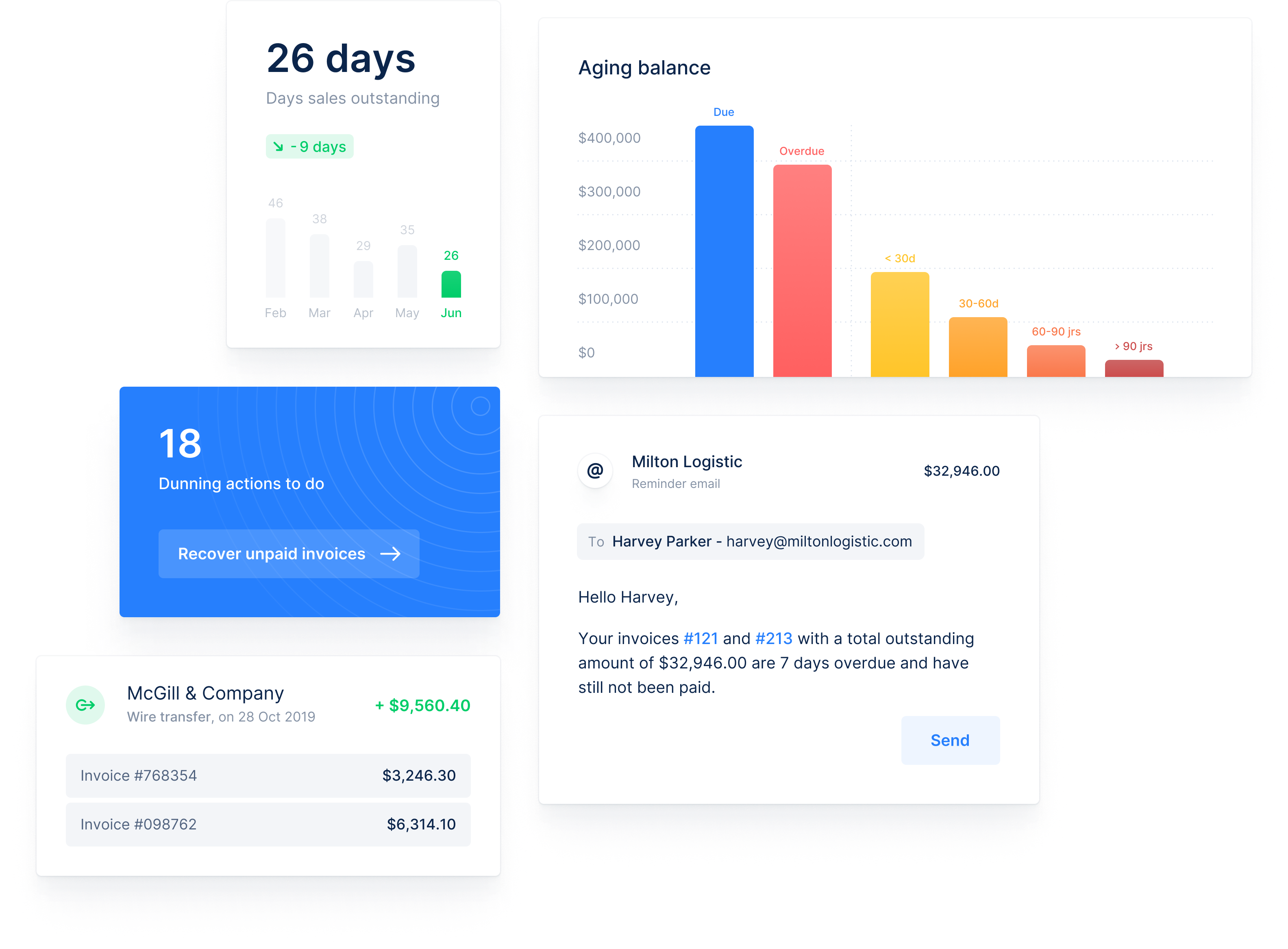

Streamline your AR process with Upflow

Upflow is an AR solution that helps automate and manage your accounts receivable process.

Standardized collection processes

Cash collection is time-consuming. AR software takes care of repetitive tasks so you team can focus on more strategic tasks.

Better cash flow management

Get paid on time and improve your business's profitability.

Standardized collection processes

Cash collection is time-consuming. AR software takes care of repetitive tasks so you team can focus on more strategic tasks.

Improved customer relationships

Automation sends early payment reminders so you don't have to chase customers past their due date.

Add Upflow to your finance stack in a few clicks

Our product connects easily with your current ERP or CRM, making it very cost-effective. We have partnerships with accounting software like Quickbooks, Xero, or Netsuite but can also set up specific APIs.

Upflow had drastic impact on our cash collection strategy at Front and makes it easy to reach all our customers, whether it's SMB or Enterprise customers!

Industry leaders love Upflow

We've helped make finance team's daily tasks much easier since 2018!

Angeles A

Customer Success Manager @ Skeepers, Madrid.

Perfect and very clear to keep track of your customers.

Jean-Thomas Cock

VP Finance @ Proxyclick

We’re getting replies from customers, Upflow works very well on the 30-60 days overdue range.

Chloé D.

Lead Finance Ops @ Partoo

A tool that allows you to organize your daily collection tasks easily and efficiently

Briac Lescure

CEO @ Popchef

Since starting to use Upflow, we've become a lot more efficient in following up on each client. This helps us build and maintain better client relationships.

Armish S.

Business Operations @ Sampler

Super easy to use, and maintain. Seamless integration leads to great visibility into analytics that can be used for timely decision-making.

Maxime Pari

CEO @ MyBizDev

Upflow is the perfect tool to track and chase.